Establishing Memorials

Establishing Memorials

Memorial Day is upon us! I heard this morning that gas is 4 cents cheaper than last year. Well, whoopty-do, aren’t we all excited? I suppose it’s better than a jab in the eye with a sharp stick. I also heard that there will be more people traveling this Memorial Day than last. If you are one of them, I pray you arrive and return safely. I just want to remind us to realize what Memorial Day is all about. This holiday is about remembering those that have served our country and have, as the Bible says,” have rested with their ancestors.” If it were not for these men and women who have served and sacrificed their life in combat or served and have passed away, we need not forget what they went to battle for, “OUR FREEDOM.” The Bible also reminds us of how God sees sacrifice, “Greater love has no one than this, than to lay down one’s life for his friends.” (John 15:13)

This brings me to my second point, we need to teach our young that this holiday is more than BBQs and family gatherings, or simply a day off. These are great ways to spend the day, and quality time with friends and family is a very good thing. I would just hope that you don’t let an opportunity slip by where our kids (children and teens and college) can be taught. Distance from the battle allows the remembering to grow dimmer and we are seeing that today on many college campuses with the demonstrations going on and what’s happening in our political and social climate. Most young people involved in these demonstrations against America, against Israel, against anything Western or Judeo-Christian, are mostly between the ages of 19-28. Most are US citizens and enjoy the freedoms granted here. The freedom to protest is one of those freedoms, but what’s concerning is that many of these people don’t even know why they are demonstrating. They are like sheep with an evil goat that is leading them.

You have probably heard this quote from Michael Hopf’s writing as it is going around quite a bit lately, “Hard times create strong men, strong men create good times, good times create weak men, and weak men create hard times.” We can see this principle in scripture, especially in the history of the Old Testament. We are living in similar times…weak men or women, that is to say, those who are not hardy of spirit, not grounded, not vigorous, not disciplined, not tested by hard times, will be led astray, will forget the hard times of the past. Such as these will forget the history. They will think they are revolutionizing, creating new times, when all they are doing is repeating a cycle of doom which they did not know to avoid because of their ignorance. Hard times are upon us. So Church, we need to help educate our young to appreciate all that we have in not only our nation, but in Christ! Being born in America means we have a privilege that many don’t have and that is FREEDOM. If we lose our freedoms, the least we can teach our young is that we have freedom in Christ and that we are ultimately FREE because of Him.

Lastly, I’ll take the opportunity here to clear up some rumors that are floating around. Yes, Brenda did retire from Hays County Sheriff Department as the Chaplain. The rumor that has come flooding down the ranks is that I am retiring too. Well, that is news to me unless you all have a plan that I am not aware of. When I came to Calvary, I was asked how long I planned on staying. I told them then (and there are only a few left of the “them”) that I would stay until the Lord gave me release. At this time, I have not heard that from the Lord. Yes, we do own a house in Kansas that we inherited after my parents passed and have been remodeling and have several more years of that to do. A place in Kansas is not what dictates my tenure here, the Lord does. So sorry for anyone that was looking forward to the rumors being true, they might be thinking, “Darn, I thought we might be rid of him soon!” Hopefully for most of you, it will offer a sigh of relief–I would hope so. (This is where I would use the one and only LOL that I even know how to use!) It wasn’t a rumor that I heard passed to me only once, but several times now, so I thought I better put that one to bed for good.

In the meantime, let us all press on for the high calling of the Lord–TOGETHER! Those of us who are in Christ will spend eternity together, like it or not, but here and now, there is work to do. The Gospel is still needed by those around us and time is short to get the work done, as we are one day closer for the Lord’s return.

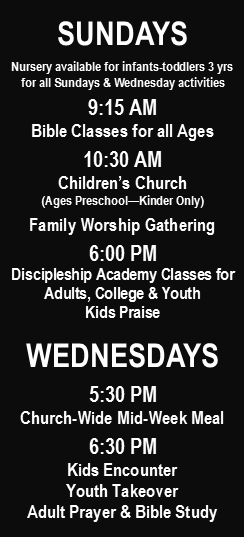

Hope to see you in church Sunday. If you’re traveling, I urge you to be in church worshiping the Lord somewhere. Finally, thanks for being understanding of having the Texas Baptist Men and Women in our facility. I know it disrupts some things, but it is all for the Kingdom’s work. Thanks for your patience.

Blessing on you!

Bro Dennis